Pan Registration In Nepal

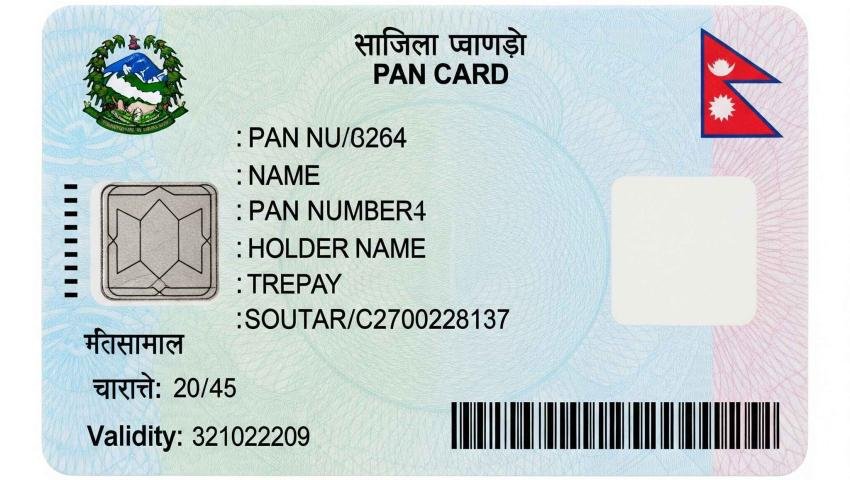

PAN (Permanent Account Number) is a unique 9-digit identifier issued by the Inland Revenue Department (IRD) of Nepal. Every individual and business conducting financial activities must obtain this crucial tax identification number.

How to Register PAN in Nepal: Complete Guide 2025

PAN Registration: Essential Tax Identification Made Simple

PAN (Permanent Account Number) is a unique 9-digit identifier issued by the Inland Revenue Department (IRD) of Nepal. Every individual and business conducting financial activities must obtain this crucial tax identification number.

Why PAN Registration is Mandatory

The Nepali government requires PAN registration for tax compliance and financial transparency. This number serves as your primary identification for all tax-related transactions and official documentation.

Legal Requirements

| Entity Type | Mandatory Requirement |

|---|---|

| Individuals | Income above taxable threshold |

| Businesses | All registered companies, NGOs, INGOs must have PAN to operate legally |

| Importers/Exporters | Required for all import/export activities |

| Property Owners | Required for property transactions |

Eligibility Criteria for PAN Registration

Understanding eligibility requirements ensures smooth registration process. The criteria vary for different applicant categories.

Who Can Apply

- Nepali citizens aged 16 and above

- Foreign nationals conducting business in Nepal

- Companies and organizations operating in Nepal

- Non-resident Nepalis (NRNs) with income sources

Required Documents for PAN Registration

Document preparation forms the foundation of successful PAN registration. Each category requires specific documentation for verification purposes.

For Individual Applicants

| Document Type | Nepali Citizens | Foreign Nationals |

|---|---|---|

| Identity Proof | Citizenship certificate | Valid passport |

| Photograph | Passport-sized photo | Passport-sized photo |

| Additional Documents | Employment certificate (if applicable) | Visa and work permit |

For Business Entities

| Document Category | Required Papers |

|---|---|

| Registration Documents | Business registration certificate |

| Identity Verification | Directors'/partners' citizenship certificates |

| Corporate Papers | Articles of association, memorandum |

| Additional Proof | Office rental agreement, utility bills |

Step-by-Step Online PAN Registration Process

The online registration process begins at ird.gov.np through the Taxpayer Portal. This digital approach streamlines application submission and reduces processing time.

Online Application Method

- Website Access

- Visit ird.gov.np and navigate to Taxpayer Portal

- Click on Registration section

- Select PAN registration option

- Form Completion

- Fill application form with accurate details

- Enter personal/business information

- Verify all data before submission

- Document Upload

- Upload required documents as specified

- Ensure clear, readable document scans

- Follow file size and format requirements

- Application Submission

- Submit completed application online

- Receive acknowledgment receipt

- Note application reference number

- Physical Verification

- Visit nearest IRD office for document verification

- Bring original documents

- Complete biometric verification

Alternative Registration Methods

Multiple registration channels accommodate different applicant preferences and circumstances. Each method offers distinct advantages for various user types.

Nagarik App Registration

The Nagarik App provides convenient mobile registration requiring citizenship certificate details, mobile number, and passport-size photo. This method suits tech-savvy applicants seeking quick processing.

Direct IRD Office Visit

Traditional office visits remain popular for applicants preferring face-to-face assistance. This method ensures immediate query resolution and document verification.

Registration Fees and Costs

PAN registration in Nepal is completely free for both individuals and businesses. The government eliminated fees to encourage widespread registration and promote financial inclusion.

Cost Breakdown

| Service Type | Fee Structure |

|---|---|

| Initial Registration | Free of charge |

| Card Replacement | NPR 100-500 (varies by office) |

| Correction/Amendment | Free for first correction |

| Duplicate Card | Minimal processing fee |

Processing Time and Collection

Understanding processing timelines helps plan registration activities effectively. Processing duration depends on application method and document completeness.

Timeline Expectations

- Online Applications: 3-7 working days

- Direct Office Applications: Same day to 3 days

- Nagarik App: 2-5 working days

- Business Registration: 5-10 working days

Common Challenges and Solutions

Registration challenges often arise from incomplete documentation or procedural misunderstandings. Proactive preparation prevents most common issues.

Typical Problems

- Incomplete documentation

- Incorrect information entry

- Document quality issues

- System connectivity problems

Expert Solutions

- Prepare comprehensive document checklist

- Verify information accuracy multiple times

- Use high-quality document scans

- Apply during off-peak hours

Benefits of PAN Registration

PAN registration provides numerous advantages beyond tax compliance. These benefits extend to personal and business financial activities.

Key Advantages

- Legal tax identification

- Banking transaction facilitation

- Business operation legitimacy

- Government service access

- Financial transparency compliance

Frequently Asked Questions

Q1: Is PAN registration mandatory for all citizens?

PAN registration becomes mandatory when earning taxable income or conducting significant financial transactions.

Q2: Can I register PAN online completely?

Online application is possible, but physical document verification at IRD office remains mandatory.

Q3: What happens if I provide incorrect information?

Incorrect information can be corrected free of charge for the first amendment through IRD office.

Q4: How many digits does a PAN contain?

PAN contains 9 unique digits assigned by the IRD system.

Q5: Can foreign nationals get PAN in Nepal?

Yes, foreign nationals conducting business or earning income in Nepal can register for PAN.

Q6: Is there an age limit for PAN registration?

Individuals must be 16 years or older to independently register for PAN.

Q7: Can I use Nagarik App for business PAN?

Nagarik App is primarily designed for individual PAN registration, not business entities.

Q8: What if my citizenship is not verified in Nagarik App?

You can still apply through traditional IRD office visit or online portal.

Q9: How do I track my PAN application status?

Application status can be tracked using reference number on IRD website or by contacting relevant office.

Q10: Can I voluntarily cancel my PAN?

PAN can be voluntarily dissolved by submitting application to IRD within 30 days of business cessation.

Professional Assistance and Consultation

Complex registration cases benefit from professional guidance. Legal and tax consultants ensure proper documentation and compliance.

When to Seek Help

- Business entity registration

- Foreign national applications

- Complex documentation cases

- Correction and amendment needs

Conclusion

PAN registration in Nepal has been simplified through digital initiatives and streamlined processes. The free registration policy encourages widespread adoption, supporting the country's financial inclusion goals.

Proper preparation, accurate documentation, and understanding of requirements ensure smooth registration. Whether choosing online, mobile app, or traditional office methods, applicants can successfully obtain their PAN by following established procedures.

Early registration prevents future complications and ensures compliance with tax regulations. Professional assistance remains available for complex cases requiring specialized guidance.

Attorney Nepal

Leave a comment

Your email address will not be published. Required fields are marked *